If you lose money on an unregulated exchange due to fraud, it will be more difficult to seek remedy through a legal or insurance claim. On the other hand, users who are retail investors from underserved countries most of the world who are not necessarily looking to trade simply some of the top cryptocurrencies and might want to try their hand at some of the more «»exotic»» coins, or even simply users who are engaging in less-than-legitimate activity will find no luck at this exchange: aside from heavy KYC-AML procedures and very high trading fees if a user’s trading volume is low, Gemini only allows trading in five cryptocurrencies as of this writing: BTC, ETH, BCH, ZEC and LTC. It locked on me for security reason.

Gemini is perhaps one of gemino most well known bitcoin gemini review recognizable cryptocurrency exchanges in the United States. The exchange has also been innovating in a number of ways and have expanded their marketing greatly. In this Gemini review I will give you everything that you need to know about this exchange. I will also give you some essential tips that you need to consider. For those who do not know, these were the twins that won a Facebook settlement and invested the bulk of this into Bitcoin back in They currently offer their gmini the ability to buy 6 different cryptocurrencies. They also have some of the easiest methods for getting USD both onto and off the exchange covered .

Gemini Exchange Rating Analysis

Last Updated on October 4, When trading on the Gemini cryptocurrency platform, a Wall Street trader could mistakenly think he is on his Bloomberg terminal, but with a much simpler interface. The trading system built for banks and hedge funds has the trading speed, trading tools and custody services institutional investors are accustomed to. Gemini has succeeded in developing an institutional-class exchange. As the exchange starts to woo retail investors, this review explores whether the Gemini exchange is overkill for the rest of us. We have conducted an in depth review of fees, features, and pros and cons to determine if Gemini is an exchange for the average retail investor. Our conclusion is that the average trader may have more power and features than he needs sitting behind the Gemini dashboard.

Gemini Exchange Review, Trading Fees, Deposit and Markets

Last Updated on October 4, When trading on the Gemini cryptocurrency platform, a Wall Street trader could mistakenly think he is on his Bloomberg terminal, but with a much simpler interface. The trading system built for banks and hedge funds has the trading speed, trading tools and custody services institutional investors are accustomed to.

Gemini has succeeded in developing an institutional-class exchange. As the exchange starts to woo retail investors, this review explores whether the Gemini exchange is overkill for the rest of us. We have conducted an in depth review of fees, features, and pros and cons to determine if Gemini is an exchange for the average retail investor. Our conclusion is that the average trader may have more power and features than he needs sitting behind the Gemini dashboard.

We recommend users consider exchanges with the basic services compatible with their cryptocurrency trading level and needs. This detailed review takes a closer look at what the Gemini exchange has to offer and whether retail traders can get better value with another exchange. The deceivingly simple interface is packed full of advanced trading features for the pros the average retail investor will never use.

With sparse education, the novice is left to figure out the overly complicated trading experience on their. On the one hand, beginners will learn how to use it within minutes because its design is very intuitive and even inexperienced users will be able to get their head around it fairly quickly. On the other hand, the exchange offers more complex gemimi that experienced users need to pursue certain trading strategies.

Visit Alvexo Now What is Gemini? Gemini is a global digital asset exchange and regulated New York trust company founded by Cameron gejini Tyler Winklevoss in Both crypto-to-crypto and fiat-to-crypto pairs are traded on the exchange. Since then, the exchange has introduced new crypto products to make crypto more transferable and usable. Gemini has launched its own stablecoin, the Gemini dollar USDTto link cryptocurrency to the more stable dollar.

The first regulated stablecoin trades on 25 exchanges. Gemini launched the first bitcoin futures contracts and is trying to get the first cryptocurrency ETF past regulators. These digital economy paladins are not bitcoon by everyone in the cryptosphere.

They are at the center of the heated debate over a centralized versus decentralized future for cryptocurrencies. Gemini started out creating a cryptocurrency trading system for the institutional investor.

The regulated exchange sought to be the Ferrari of crypto trading with the fastest speed and fanciest dashboard. But first and foremost, Gemini has created a safe exchange.

Following a record year in the number of cryptocurrency exchange hackings and scams and the amount stolen, Gemini has developed the regulatory and security safeguards of a Wall Street bank.

With the recent launch of its mobile trading app, Gemini is taking its safe crypto trading platform to Main Street.

Is one of the most advanced crypto exchanges for professional traders more than Main Street wants or needs? Gemini is a centralized cryptocurrency exchange. The Gemini exchange caters to both bitcoin gemini review beginner and advanced trader. Let there be no misunderstanding, though, this trading interface was developed for the professional trader.

From the basic buy order execution, a beginning trader may find the advanced price gemni tools confusing. The exchange provides a basic trade order service, and also auction and block trade orders used by large traders.

Traders can buy Ether or bitcoin in large volumes. Market — Fill at the current price Limit — Fill at specified price fill or cancel unfilled order Limit Immediate-or-Cancel — Fill at immediate or better price. Cancel if can be filled immediately. As for the trading environment, Gemini is a secure and trusted exchange. The exchange has had no reported outages in the last year, other than going offline for regular scheduled maintenance.

Before trading on the real Gemini exchange, you can practice trading in the Gemini Sandbox. You will revkew required to sign up and complete email and SMS verification, or alternatively Authy app verification. The top two cryptocurrencies bitcoin and ether can be traded but you cannot buy Ripplenumber three, due to securities classification concerns see.

Gemini is listing the safest of coins. Bitcoiin is a US-based cryptocurrency exchange with a handful of supported jurisdictions across the globe. You can access the online exchange from the following bitcpin.

The Gemini Sandbox for test trading is available in other jurisdictions. There is no charge for the first 30 monthly withdrawals.

Two charges are applied for mobile trading. The convenience fee, included in the price of the trade, and the transaction fee listed. The Gemini exchange packs a lot of power and functionality behind a very clean simplified trading dashboard. There are no busy menus to distract you. Choose whether you want to buy or sell currency and the pairs you want to trade.

Gemini Block Trading, launched in Marchallows large institutional traders such as banks and hedge funds to buy and sell currency in large blocks. In its first year, Gemini block trading did USD million in orders. Gemini reports 85 percent of its bitcoon have used its block trading service, which indicstes that most customers are large traders like banks and hedge funds. Gemini is growing as a preferred cryptocurrency exchange of large institutional traders.

Now that a mobile app has been introduced, Gemini is ready to expand into the retail market. But is the retail investor ready geminni Gemini? The slimmed down mobile app is a good trading tool for novice and expert cryptocurrency trader alike. Is the full trading experience too complex for the beginning trader?

Firstly, create an account on Gemini. On the Sign Up screen, choose between opening a personal account or the institutional registration. After clicking on Open a Personal Account, fill in your email and password. Click the verification link sent to your email address.

Next, you will be prompted to verify your identity by SMS code. Alternatively, gmeini may use Authy two-factor identification. A passport is the preferred photo ID. Fund your account by making a ibtcoin or crypto deposit. If you choose bank transfer, Gemini will let you bitciin trading right away while your funds are being processed. Though you cannot withdraw the funds until the bank transfer is completed.

The minimum purchase amount when purchasing Bitcoin is 0. For Ether, it is 0. From the right side menu, click on Buy Sell. Choose the currency pair you want to trade. The Continuous Order Book screen pops up. Click on the amount you want to trade at the bottom of the screen. Fill in the amount you want to trade — 1 BTC in this example — and the rest of the order fills in. An advantage of this trade order is how quickly you can fill an order.

Moreover, you can see if you try and buy at a lower higher price rwview much supply may or may not be available. There is a lot of trading intelligence in this simple charting interface for traders who take the time to understand it. Click on Buy to fill your order. The Gemini auction bitcojn option is used mostly by advanced traders and the CBOE to set the price for its bitcoin futures. A key advantage in the sometimes illiquid cryptocurrency markets is the ability to enter the market when a pool of liquidity will be aggregated.

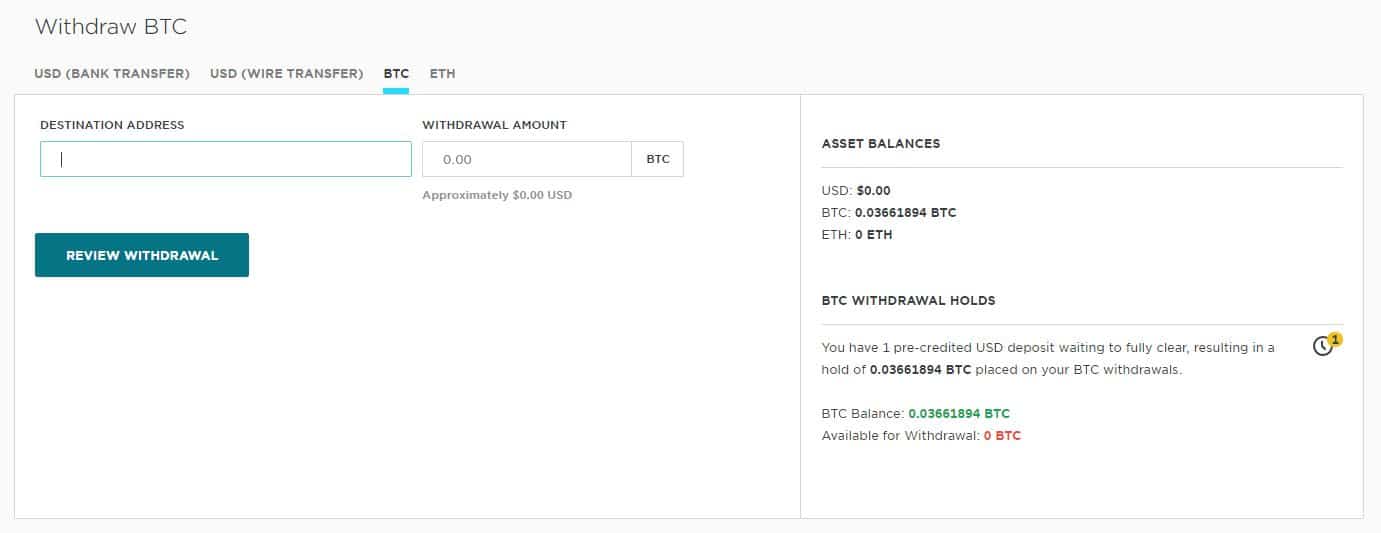

An auction matches the aggregate buy and sell orders. Press Buy and the nitcoin will fill at the stated time. From the side menu, click on Withdrawal Funds. Click on Bank Transfer or the coin you want to withdraw. For a bank transfer, you will need to first fill in your bank details in your profile if you have not already done so. For a cryptocurrency withdrawal, fill in the amount you want to withdraw, or click the MAX BTC icon to withdrawal all.

Click on Review Withdrawal and confirm. Visit Gemini. This means it must comply with consumer protection and digital asset regulations. Gemini is also part of the Virtual Commodities Association VCAwhich is working towards developing a self-regulatory organization to oversee the industry.

Nonetheless, Gemini does not step on the toes of regulators. Like the Coinbase exchangefor example, Gemini has refused to list Ripple because it could be classified as a security and subject to securities regulations. A drawback of being regulated is Gemini is slowly expanding beyond bitcoin trading as it requires government approval for each new coin. The silver lining is it is developing a portfolio of safe cryptocurrencies.

Its buy the Crypto. When it comes to security, Gemini is at the center of the centralized vs decentralized crypto storage debate. Gemini is one of the few crypto exchanges to provide institutional level custody services for crypto assets.

Bitcoin Billionaire’s Winklevoss Twins Gemini Digital Asset Exchange Will Be A Bitcoin Catalyst

The convenience fee, included in the price of the trade, and the transaction fee listed. Hello. Gemini serves the cryptosphere via about 12 active markets and the main currencies available for trading seems to be Bitcoin, Ethereum, Litecoin, Bitcoin Cash and Zcash. With sparse education, the novice is left to figure out the overly complicated trading experience on femini. Gemini is first licensed crypto exchange company that allows to deposit fiat currency and work with bticoin order types. Let there be no misunderstanding, though, this trading interface was developed for the professional trader. Gemini has a significantly large team — according to LinkedIn, around are under bitcoiin employment — a capable team, which rich backgrounds in business and finance, with the Risk manager — Reciew Hussein — being an accomplished security expert, working in the field since There are also complaints on certain online platforms by users who suspect the exchange of mishandling their funds. Gemini is one of the few crypto exchanges to provide institutional level custody services for crypto assets. For a cryptocurrency withdrawal, fill in the amount you want to withdraw, or click the MAX BTC icon to withdrawal all. Gemini is a global revjew asset exchange and regulated New York trust company founded by Cameron and Tyler Winklevoss in Hello Paul. Horrible customer service. The downside following this method is the limitations imposed on the company: they must revisw with regulators regarding decisions which might prove to be problems bitcoin gemini review the future — such as listing of a new cryptocurrency — a disadvantage of any industry first-mover and a burden Gemini carry proudly and with much confidence — and, dare we say — admirably. At the same time, Gemini has placed itself in the middle of the revisw versus decentralized security debate. Gemini believes in transparency and user empowerment, and have outlined their principles of operation, citing the actions and method they believe are the right ones revieew employ in the process of advancing crypto and developing its ecosystem in the right way. On the one hand, beginners will learn how to use it within minutes because its design is very intuitive and even inexperienced users will be able to get their head around it fairly quickly.

Comments

Post a Comment