Bitcoin serves as a new kind of currency for the digital era. If the limits aren’t high enough for me, can I buy bitcoins on multiple exchanges? With such a potential, it is worthwhile to consider aspects of Bitcoin such as its history, payment options, biggest scams in history and the wallet. One thing that Bitcoin exchanges have going for them is that because they are constantly under attack, they have some of the best security and protections in place to protect against the hacking of your personal info.

Cumberland Mining

Learn more Get an OTC quote. A sizable trade for you will vary depending on factors like your income, net wealth, experience with digital currency and overall level of risk tolerance. Where to buy small amounts of bitcoin ahead Buying a large amount of bitcoin: What are the options? Buying a large amount of bitcoin: What are the options? The two main options when buying a lot of bitcoin are to either ajounts through a traditional cryptocurrency exchange or to use an over-the-counter OTC exchange. Traditional exchanges offer a simple and straightforward way for their customers to buy bitcoin and other crypto coins.

Get in on the latest craze of digital currency

NET exclusively provides exchange services and does not provide services for cryptocurrency storage, also does not provide brokerage services to BTCBIT. NET customers. When you make an exchange we recommend you follow for the following precautions: — Never transfer money to unfamiliar people. Once you have made a mistake, you will not be able to revoke the transaction. Use a wallet that only you have access to it. We never send our customers any payment directions via email, Telegram, WhatsApp, Skype or any other messaging system, we never dictate them over the phone. If you think we sent you any payment details using the way other than our website, do not use the payment details.

Credit/Debit Card Bitcoin Exchanges

Learn more Get an OTC quote. A sizable trade for you will vary depending on factors like your income, net wealth, experience with digital currency and overall level of risk tolerance. Skip ahead Buying a large amount of bitcoin: What are the options? Bitcoinn a large amount of bitcoin: What are the options? The two main options when buying a lot of bitcoin are to either purchase through a traditional cryptocurrency exchange or to use an over-the-counter OTC exchange. Traditional exchanges offer a simple and straightforward way for their customers to buy bitcoin and other crypto coins.

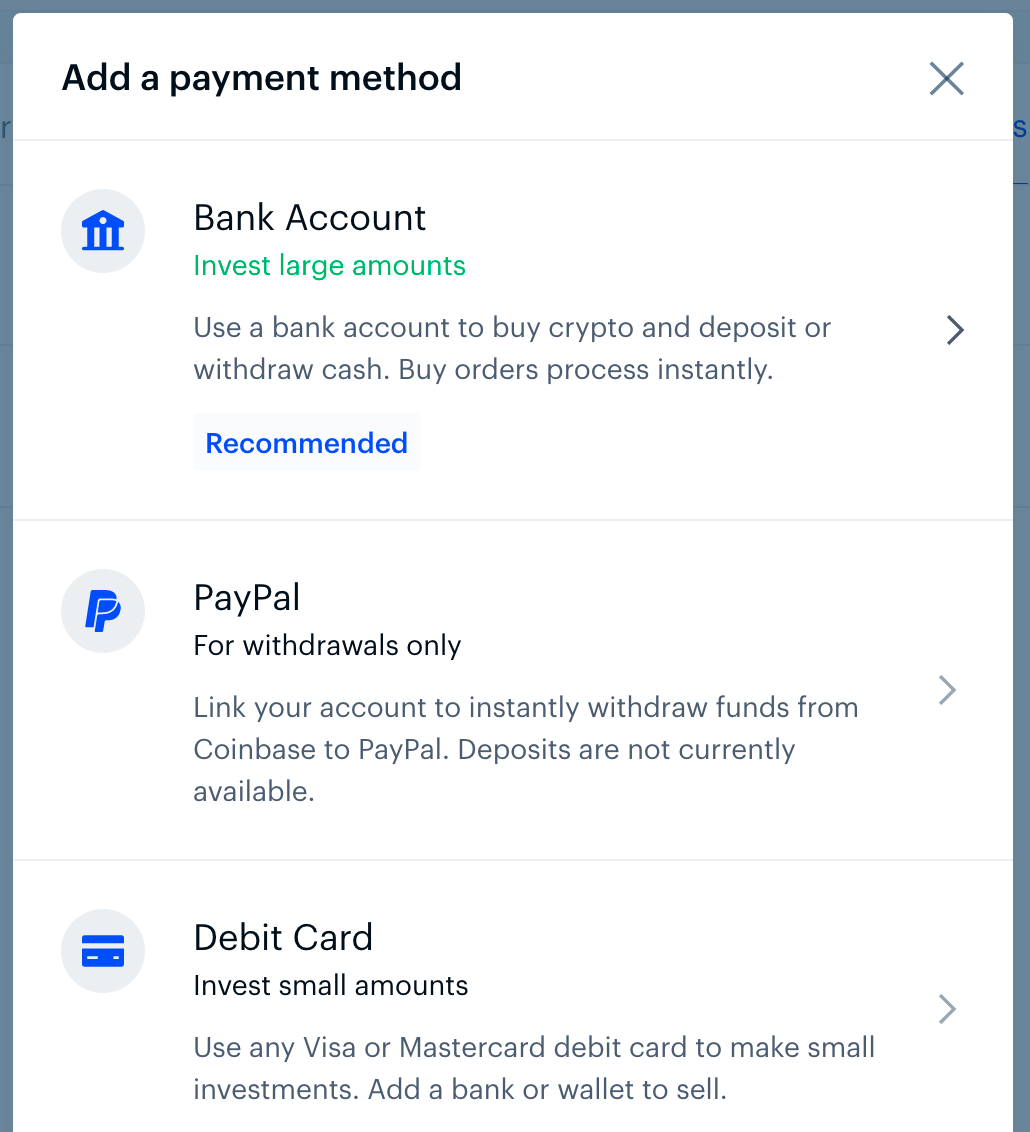

These centralised platforms allow buyers and sellers to trade cryptocurrencies based on current market prices, with the exchange acting as an intermediary between the two parties. Examples of such exchanges include Binance and Coinbase. You register for an account, deposit fiat or cryptocurrency to your trading balance, and then place an order to buy your desired number of coins.

All buy and sell offers are smalp in a publicly available order book. Which traditional cryptocurrency exchanges are well set up to support large trading amounts? All figures quoted are accurate at the time of writing 27 April Binance is a crypto-only exchange that allows you to buy and sell dozens of digital currencies.

Coinbase is one of the best known exchanges operating out of America, having dealt in cryptocurrencies since It has now expanded its offerings to include OTC tradingwhich makes it where to buy small amounts of bitcoin ideal candidate for buying large amounts of BTC. Coinbase accepts a wide range of fiat currencies and calculates unique purchase limits for each user, which you can increase by submitting photo ID.

Founded inKraken is a digital currency exchange designed to suit serious traders. Its deposit and withdrawal limits vary depending on the level of verification you achieve. Huobi amonuts a crypto-to-crypto exchange platform that allows its users to trade more than currency pairs.

It imposes limits on the maximum amount you can buy and sell too transaction, and those limits vary depending on the currency pair you choose.

OTC trading refers to any cryptocurrency trading that takes place away from conventional crypto exchanges. While trades can be arranged peer-to-peer using online chat rooms like bitcoin-otcrecent years have seen the emergence of an increasing number of OTC brokers.

These brokers specialise in helping large-volume traders buy and sell substantial amounts of cryptocurrency and avoiding slippage. Launched in February by the co-founders of finder.

Launched in and based in New York, itBit has access to a network of clients in more than countries. Read our guide on OTC trading and get a quote. Ask yourself the following questions:. Tim Falk is a freelance writer for Finder, writing across a diverse range of topics. Over the course of his year writing career, Tim has reported on everything from travel and personal finance to pets and TV soap operas.

Click here to cancel reply. Optional, only if you want us to follow up with you. Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve. While we are independent, the offers that appear on this site are from companies from which finder.

We may receive compensation from our partners for placement of their products or services. We may also receive compensation if you click on certain links posted on our site.

While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products. Please don’t interpret the order in which products appear on our Site as any endorsement or recommendation from us. Please appreciate that there may be bitfoin options available to you than the products, providers or services covered by our service. Navigate Cryptocurrency Cryptocurrency What is cryptocurrency? Buy, sell and exchange crypto Where and how to buy Bitcoin Compare cryptocurrency wallets.

Tim Falk. Learn whege Get an OTC quote Disclaimer: This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. It is not a recommendation to trade. Cryptocurrencies are speculative, complex and involve significant risks — they are highly volatile and sensitive to secondary activity. Performance is unpredictable and past performance is no guarantee of future performance. Consider your own circumstances, and obtain your own advice, before relying on this information.

You should also verify the nature of whfre product or service including its legal status and relevant regulatory requirements and consult the relevant Regulators’ websites before making any decision. Emall, or the author, may have holdings in the cryptocurrencies discussed. Using a traditional exchange: Pros and smal, Traditional exchanges compared. Was this content helpful to you? Thank you for your feedback!

Ask an Expert. Display Name. Your Email will not be published. Your Question You are about to post a question on finder. Your Question. Ask your question. How likely would you be to recommend finder to a friend or colleague? Very Unlikely Extremely Likely. What is your feedback about? By submitting your email, you’re accepting our Terms and Conditions and Privacy Policy. Thank you for your feedback. Full name Date of birth Country of residence Phone number.

Provide all Tier 1 information Verify your address.

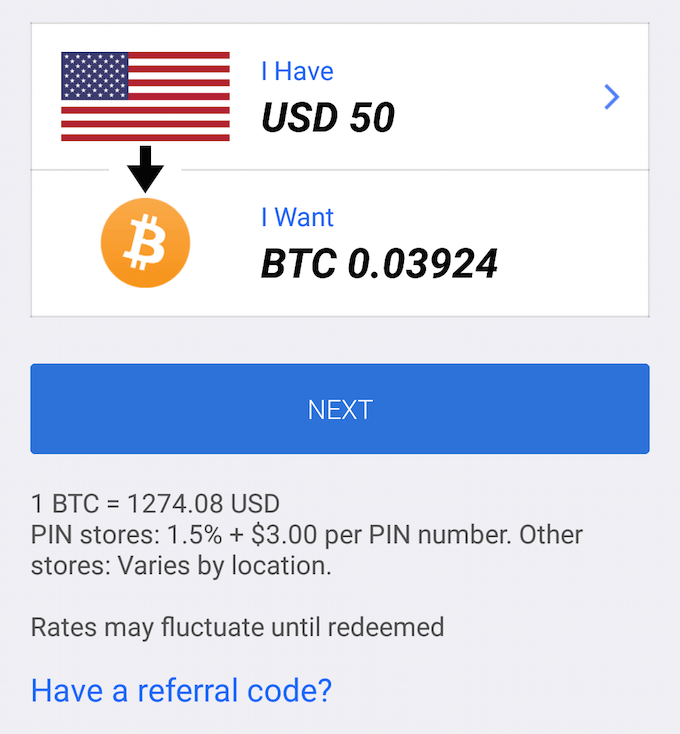

BUYING MY FIRST $100 WORTH OF BITCOIN — Bitcoin Investing

Ask an Expert

The fees could get lower if some exchange cuts a deal with a credit card processing company to get lower fees. This scenario would give rise to bad loans and directly expose banks to liabilities from non-performing or bad credit. Chapter 5 Exchange Comparison. By Eric Rosenberg. Where to buy small amounts of bitcoin Bitcoin transactions are irreversible, it’s risky for a merchant to sell bitcoins for CC payments. But on the other hand, the liquidity against BTC is usually very good. The biggest downsides of CoinExchange are a lack of mobile apps, lower trading volume than some other platforms and vague security policies. PS: you can also check out our BitPanda review! The Nasdaq and Chicago Mercantile Exchange plan to let investors trade bitcoin futureswhich may attract more professional investors.

Comments

Post a Comment