Buyer lost 0. Get answers on demand via Facebook Messenger. Prefer one-to-one contact? While futures products still carry unique and often significant risks, they can potentially provide a more regulated and stable environment to provide some exposure to bitcoin as a commodity as well. Binary options are available through a number of offshore exchanges, but the costs and risks are high.

Top articles

Last Updated on September 13, Bitcoin options are traded on specialized Bitcoin options exchanges that offer different functionalities and terms. Options are pput type of derivative, which means they are based on an underlying asset, such as commodities, stocks or cryptocurrencies. Depending on the type of option contract held, buyers will be given the opportunity to buy, or sell the underlying asset at a given value, known as the strike price within a specific time period. Call option holders have the opportunity to buy an asset at a fixed price within a certain time window, whereas put options have the opportunity to sell at a fixed price during a certain time window. When investing in Bitcoin options, investors pay a premium for the chance to buy or sell Bitcoin at a set price in future, essentially providing a clever way to long or short BTC, giving owners vitcoin opportunity to make gains in a declining market, and multiply their profits optioms a bull market. As with all options, Bitcoin options holders must exercise their option by the oyu expiration date, after which the option position will be closed.

Bitcoin futures trading is here

Due to various reasons it can happen that options are being traded at prices that can be regarded as having taken place in an abnormal non orderly market, where the chance is very high that one side of the trade has been done unwillingly. In such cases Deribit might adjust the prices or execute reversing trades. For example if an option is traded at a price of 0. If a trader realises a trade executed at a price regarded as being mis-priced, he should write an email to the exchange support deribit. The theoretical price of the option is the mark price, though it is difficult for the exchange to at all times have the mark price exactly at theoretical prices. So in case of disagreement about the theoretical price, this price will be determined consulting primary market makers on the platform. Deribit will follow their recommendations as for what was the theoretical value of the option at the moment of trade if there is any disagreement.

Options Trading: Understanding Option Prices

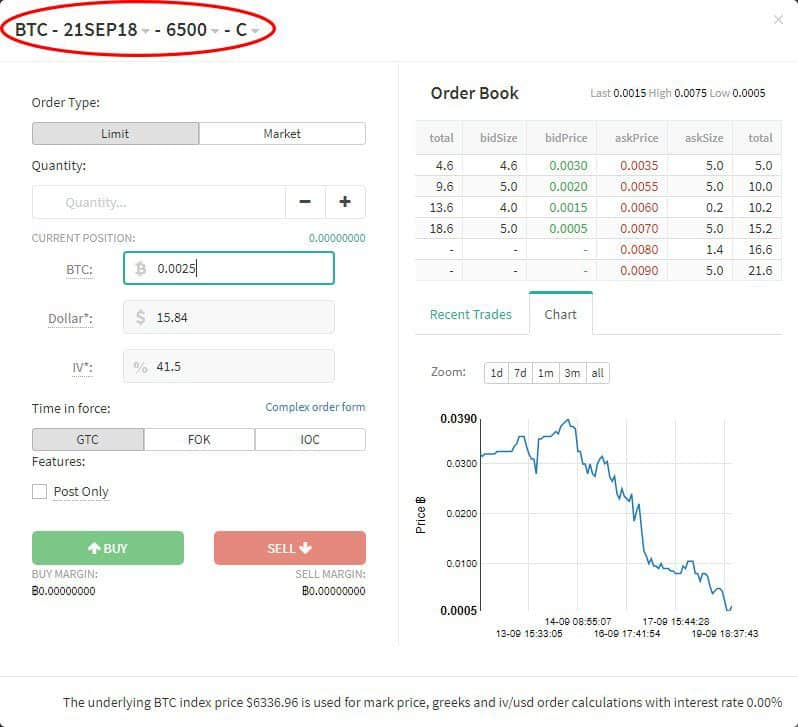

You can see a chart of the development of the can you buy put options on bitcoin 15 days historical volatility of the Deribit bitcoin index. In the case of USD price and Implied Volatility price, the Deribit engine will continuously update your order as to keep respectively the USD value and the Implied Volatility at the fixed value as given in the order form. At any time Deribit risk management sets hard limits to the minimum and maximum implied volatility allowed as mark price. Your Money. This is the right to buy 1 BTC for 10, dollars. Cryptocurrency Bitcoin. But it is possible through the order form to submit volatility orders and constant USD value orders. The annualised bitcoin historical volatility is calculated over a period of 15 days.

Comments

Post a Comment