Bitcoin loans are new and not well regulated. Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve. BlockFi has a lower entry barrier as compared to Unchained Capital, and it is operational in more areas. Super Security: Bitcoin is very secure due to its blockchain design which features advanced cryptography during the transaction process. Customers can now easily expand their crypto portfolio with borrow bitcoin. However, with YouHodler, this volatility does not have to be an issue. New York-based non-banking lender BlockFi is one of the most popular companies offering cryptocurrency-backed loans.

What is a Bitcoin loan?

Last Updated on November 29, This is the ultimate guide to the best Bitcoin loan platforms. Platforms like Bitconnect or LoopX have resulted to be Bitcoin lending site scams and disappeared with the money of hwo of gey. If you want to stay on the safe side and get cheap and easy Bitcoin loans, then make sure to read this guide until the end. Though Nexo is one of the more recent additions to this list, it has garnered quite the reputation tto its short time, owing to its impressive range of services on offer, and how to get a loan to buy bitcoin transparent operating practices. Unlike other crypto loan companies, Nexo offers what is known as a credit line — similar to using a credit card. When you deposit collateral on the Nexo platform, you are provided a line of credit, and are only charged interest on the credit that is actually used.

Should you risk borrowing in this volatile currency for low rates and no credit requirements?

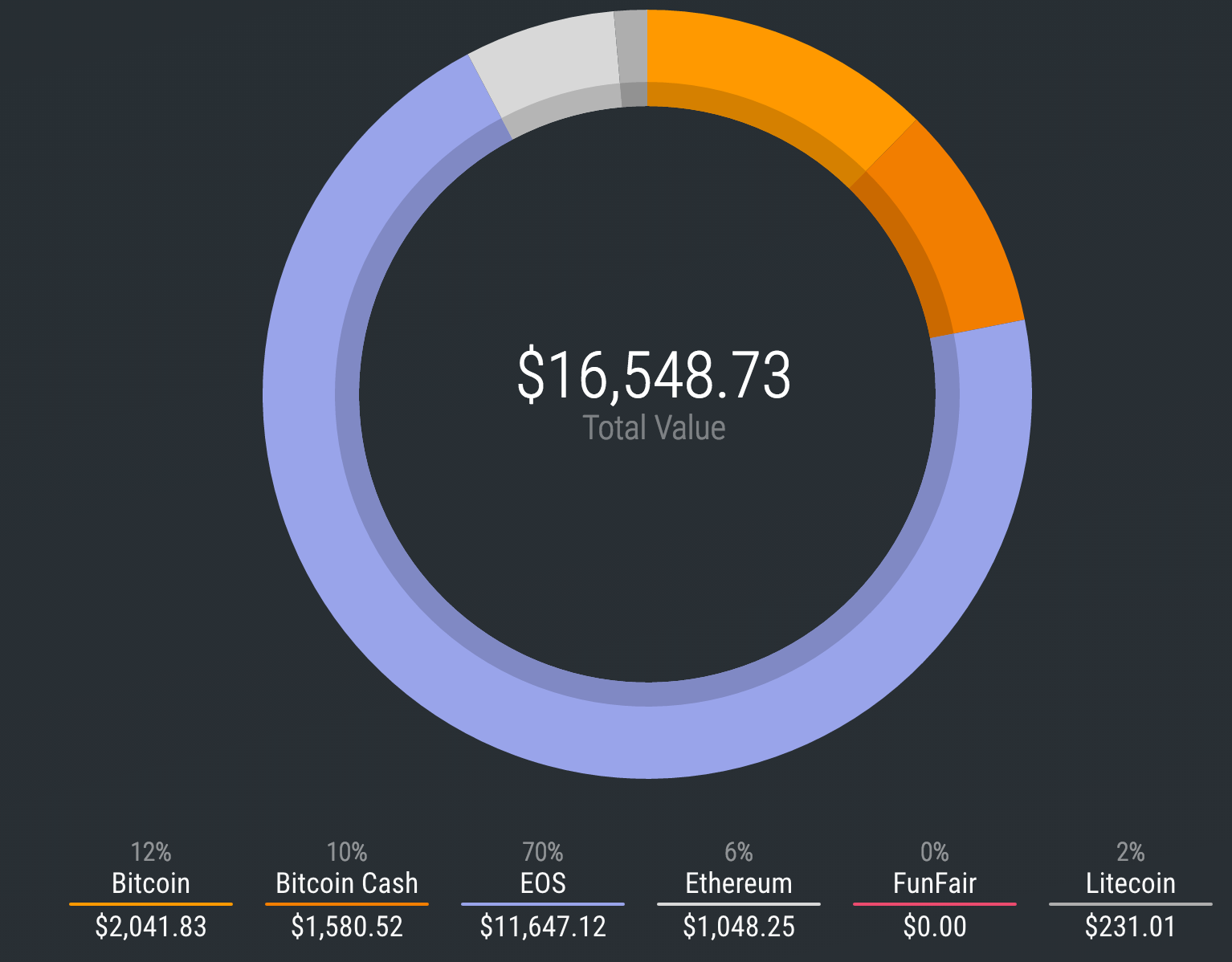

Users can borrow money by keeping their Bitcoins as collateral, which has to be paid back with interest over the predetermined time period. The borrower can choose to pay back the loan in monthly equated installments or at once depending on the terms of the agreement. Those purposes might include anything such as traveling the world, buying a home, diversifying a portfolio by investing in other asset classes, investing in a business, or paying off other high-cost debt. So, once a user has weighed the pros and the cons of taking out a Bitcoin-backed loan, they can look at some of the following offering Bitcoin-backed loans. Unchained Capital is another crypto-finance company that potential borrowers can look at to get a loan on their crypto holdings.

Ask an Expert

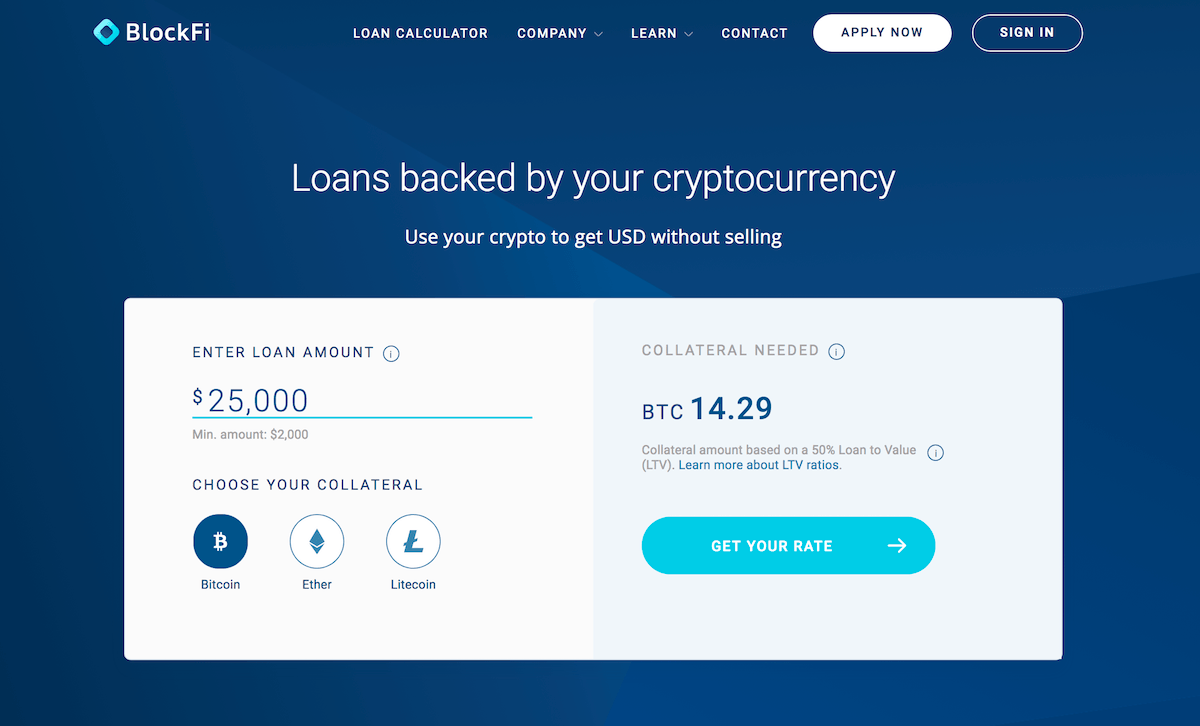

BlockFi has a lower entry barrier as compared to Unchained Capital, and it is operational in more areas. About YouHodler. As the most popular crypto on the market, there are many advantages and some disadvantages to receiving how to get a loan to buy bitcoin Bitcoin loan. How are bitcoin loans different from other peer-to-peer loans? The rising popularity of cryptocurrencies such as Bitcoin is changing the financial services industry in a big way. Please appreciate that there may be other options available to you than the products, providers or services covered by our service. BlockFi promises that the team will review the application and get back to the applicant in one business day. Borrow Bitcoin: Pros and cons Pros Decentralized: BTC is not vulnerable to the actions of a central governing authority such as financial institutions, political body or bank executives. Thank you for your feedback! She loves to eat, travel and save money. How likely would you be to recommend finder to a friend or colleague? Your Question. Ask your question. Click here to cancel reply.

Comments

Post a Comment